A Guide on the Road to Retirement

The title of the Beatles’ song “The Long and Winding Road” could apply to the journey toward a comfortable retirement. For those who have the foresight to start preparing in their 20s, the journey could take 40 years or more. Even those who procrastinate might have 20 or 30 years to prepare.

No matter how long the road, there are sure to be plenty of winding turns along the way. A survey conducted after the 2008 recession found that 9 out of 10 people ages 50-70 had experienced at least one “derailer” that knocked them off the track to retirement (1). Although the broader economy played a part, many challenges were more personal, such as starting late, balancing college and retirement savings, and experiencing a traumatic event.

Where Do You Turn for Advice?

A recent industry study found that 17% of retirement plan participants did not seek any retirement advice at all. The most common source of advice, cited by 29% of plan participants, was the official information provided by their retirement plan provider (2). This may be a good place to start, but such information is typically broad and impersonal, aimed at the group rather than tailored to individual circumstances.

There is also a seemingly endless stream of information available online. Some of it can be useful, too, but you have to be careful when listening to self-appointed “experts” who may or may not have the appropriate experience for the opinions they express. And online information is also aimed at the crowd.

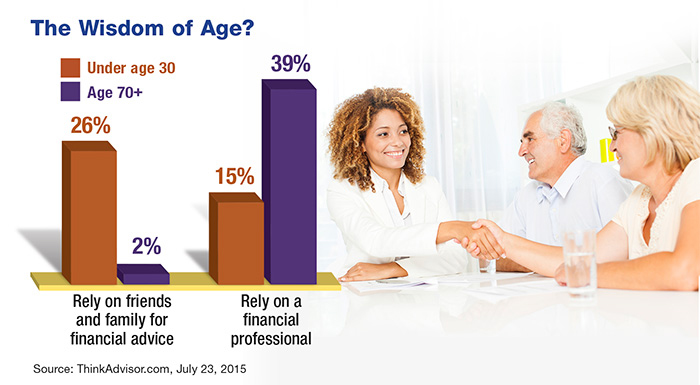

So, where do people turn for more personal advice? The study revealed a clear generational divide. Younger Americans tend to ask family, friends, and colleagues. Meanwhile, older Americans, who are closer to retirement or have already retired, are more likely to work with a financial professional (see chart). On one level, it makes sense that younger people might turn to those they already trust rather than establish a new relationship with a financial professional.

Considering the long road ahead, it might be just as important to take advantage of professional insight earlier in one’s career. In a survey of Baby Boomers, 86% who worked with a financial advisor said they were better prepared for retirement because of the help they received (3). Even if retirement is still in the distance, why not take a tip from the Boomers and establish a solid, well-considered foundation now so that you can progress more confidently toward your long-term goals?

If you’re closer to retirement or already there, you may have an even more immediate need for guidance. Of course, there is no assurance that working with a financial professional will improve investment results. By focusing on your overall objectives, a professional can provide education, identify strategies for taking control of many financial situations, and help you consider options that could have a substantial effect on your long-term financial situation.